$6,970 Raised for Inaugural Brant United Way Workplace Campaign

As President of Oak House Benefits, Don Williamson is proudly carrying on a culture of caring that has spanned generations. Oak House Benefits, in our inaugural Brant United Way "Move Brant Forward Campaign" raised an impressive $6,970.00, with 100% employee participation.

Left to right: Don Williamson, Paul Williamson

As President of Oak House Benefits, Don Williamson is proudly carrying on a culture of caring that has spanned generations. Oak House Benefits, in our inaugural Brant United Way "Move Brant Forward Campaign" raised an impressive $6,970.00, with 100% employee participation. Following in the footsteps of his father, Paul Williamson, employee donations were matched dollar-for-dollar by the company, continuing The Williamson Group's tradition of contribution matching, and reinforcing the importance of employees giving back to their community.

The Brant United Way is an organization near and dear to the Williamson family, and an organization Oak House Benefits is proud to continue to support. Don's grandfather, Donald D. Williamson, was the first campaign chair for the Brant United Way in 1948, and again in 1952. Don's father, Paul, chaired the Brant United way in 2000. He is currently Vice-Chair of the 2020 campaign, along with Dave Levac.

Takeaways from Benefits Canada’s: Face to Face Drug Plan Management Forum

Emerging high-cost drug treatments have been posing a risk to benefit plans at an exponential rate over the last several years. Due to these risks, drug plan management is becoming an increasingly popular topic. Not only concerning how to effectively manage the risk of high-cost claims, but also ensuring your plan is designed in a way that improves health outcomes for all.

We had the opportunity to attend the Benefits Canada Virtual Drug Plan Forum and would like to share our key takeaways.

Emerging high-cost drug treatments have been posing a risk to benefit plans at an exponential rate over the last several years. Just one high-cost drug can deteriorate a plan sponsor’s claims experience in the blink of an eye, especially for smaller employers with traditionally low claims, or those with Administrative Service Only (ASO) funding arrangements who are assuming most of the risk. Not only is this a risk to plan sponsors financially, but it also inhibits the ability to make a carrier change, or in some cases, make certain plan design changes.

Measures that once created an “out of sight, out of mind” mentality, such as stop loss thresholds, are no longer providing the same level of security. Many plan sponsors are not prepared for the increases that insurance carriers are applying to their stop loss charges across their block of business to account for these unpredictable claims. For ASO clients, the risks are even higher, and fees could be detrimental if claims reach substandard risk levels.

Why is this important?

Due to these risks, drug plan management is becoming an increasingly popular topic. Not only concerning how to effectively manage the risk of high-cost claims, but also ensuring your plan is designed in a way that improves health outcomes for all.

We had the opportunity to attend the Benefits Canada Virtual Drug Plan Forum and would like to share our key takeaways.

1. Prior authorization (PA) processes need to be simpler & quicker to be effective.

Prior Authorization is an integral part of the drug plan management toolkit. It is a tool that manages individual plan member decisions and provides a process for review of patient information prior to drug submission. The current PA process involves many hand-offs, and as such, it is not typically top of mind for plan sponsors when considering cost containment strategies. Digitizing the PA process (known as ePA) will add simplicity, increased time savings, and allow for richer analytics to be used by carriers. Additionally, it will allow for more drugs to fall under PA leading to greater potential for cost savings down the road.

2. Drug plans can lack inclusion without plan sponsors knowing it.

(i) Anti-Obesity, or ‘Lifestyle Drugs’

There is more to obesity than measures of size (BMI) and there is more to supporting employees with this disease than only offering a wellness program. According to Dr. Sean Morton, medical director of the Wharton Medical Clinic, society tends to be biased towards obesity and believes in an ‘eat less, exercise more’ mentality. Treatment needs to move away from this mentality to a focus on overall health while determining the root cause of the disease. Evidently, some of the exclusions that exist in employee benefit plans require employees to jump through unnecessary hoops to fulfill their weight-loss treatment plans, such as weight-loss drugs. One of the pillars of weight-loss management is pharmacological therapy. When excluding these from the drug plan offering, you may be sending the message to your employees that you do not support their weight-loss management journey.

(i) Diabetes – Flash Glucose Monitors

In 2021, Canada will celebrate the 100th anniversary of the discovery of insulin—a discovery that has changed the lives of many around the world. According to the 2020 TELUS Health Drug Trends report, drugs for diabetes ranked second in the therapeutic drug category for the second year in a row due to a combination of both volume of claims and price. Dr. Bruce Perkins, professor of medicine at the Division of Endocrinology and Metabolism, and the Institute of Health Policy, Management and Evaluation at the University of Toronto, discussed the importance of flash glucose monitors and their impact on supporting plan members who are living with diabetes. While helpful for both Type I and Type II diabetics, this technology is especially significant for positive health outcomes in Type I diabetics due to the complexity of the disease. In conclusion, these monitors can lead to lower benefit plan costs because of their impact on adherence and reduced hypoglycemia.

3. Lack of access to proper drug treatment options can lead to a spillover effect in other areas, leading to deteriorated health outcomes through increased disability incidence rates, increased absenteeism, and decreased productivity.

(i) Pharmacoeconomics & HRA

Pharmacoeconomic testing is the science of quantifying the value of a particular drug by looking at how it improves health outcomes as a measure of value. Specialty drugs occupy 42% of total drug spend in 2020 – up from 30% in 2015 and 17.5% in 2010. Public and private payers have different objectives. As they cover different populations, they have different needs. Currently, the majority of cost analyses is formed from the public payer perspective. Research suggests that taking a tailored approach could lead to more objective coverage decisions and thus improved health outcomes.

(ii) Pharmacogenomics and Mental Health Drugs

Pharmacogenomics, also known as pharmacogenetic testing, uses an individual’s DNA to assess how they will respond to certain medications and indicates which drugs may be most compatible. Drug treatments for mental health conditions are not straightforward, with many physicians having to use a ‘trial and error’ approach to find the most effective medication. Mental health related conditions have also been on the rise since the start of the pandemic, with 17% of claimants taking antidepressants. Introducing pharmacogenetic testing as part of managing these conditions can significantly improve patient health outcomes by allowing clinicians to provide personalized treatment. This can improve overall benefit costs through less experimentation, improved drug adherence, decreased visits to health care professionals, lower disability incidence rates and eliminate delays in getting employees back to work. Carriers understand this potential impact, and as such, ten Canadian insurers now offer at least one coverage option for pharmacogenomics under their disability or extended health benefits.

The point?

While it is important to manage costs and mitigate risk to your plan as much as possible, doing so is only effective if it is not causing spillover into other areas such as restricting access to treatment. Finding that balance is key. There are many ways that exist and are continuously evolving to ensure your benefits plan is inclusive for all, while managing costs simultaneously.

We would love to discuss drug plan management with you more and are always here to help. Let us review your drug plan to assess whether you are best supporting employees while effectively managing costs.

Meghan MacPherson

Senior Underwriter

Changes to EI Maximum Insurable Earnings and Impact to Plans with Short-Term Disability

The Canada Employment Insurance Commission (CEIC) have reported the changes to the Maximum Weekly Insurable Earnings (MWIE) and Maximum Insurable Earnings (MIE), which come into effect January 1, 2021.

The Canada Employment Insurance Commission (CEIC) have reported the changes to the Maximum Weekly Insurable Earnings (MWIE) and Maximum Insurable Earnings (MIE), which come into effect January 1, 2021.

MIE will increase from $54,200 to $56,300, which increases the Maximum Weekly Insurable Earnings (MWIE) from $1,042 to $1,083. As EI benefits are 55% of the MWIE, the EI benefit increases from $573 to $595.

What Does This Mean for Plan Sponsors?

EI Premium Rate Update

Due to the economic impact of the global COVID-19 pandemic, the Government of Canada authorized a temporary freeze to the EI premium rate for 2021 and 2022 at the 2020 level. The EI premium rate will remain at $1.58 per $100 of insurable earnings for employees. For more information, visit Canada Employment Insurance Commission.

At Oak House Benefits, we’re here to help. We would be pleased to review your plan to ensure you remain qualified for the EI premium reduction program. Please reach out and say hello – we can’t wait to hear from you.

Sandra Scott

Principal Consultant

Oak House Benefits

The Drug Plan Conundrum: An Intricate and Difficult Problem

As a consultant, I have been bringing the concept of drug formulary management to my clients for many years but have consistently seen a reluctance from plan sponsors to adopt drug formularies out of concern for disrupting their employee group. There was a time when technology did not support a smooth transition to a managed formulary, but that time has passed.

It doesn’t seem that long ago (although it’s been a decade now) that the infusion of generic drugs created the drug patent cliff, where the number one or two top drug plan spends – think Lipitor and Lyrica - tumbled down the cost list, eliciting a sigh of relief from plan sponsors and advisors alike. Relief, however, was short-lived as the costs of specialty and biological drugs have been steadily and relentlessly creeping higher and, in turn, increasing costs to both employers and employees. Despite the remarkable patient outcomes witnessed with these medications, there are still a few key questions to consider:

As a company, are we spending our money as wisely as we can?

Can we and our employees sustain the increasing costs to the benefit plan, through premiums and co-pays?

What options can we explore that reduce costs, but not quality of care?

As a consultant, I have been bringing the concept of drug formulary management to my clients for many years but have consistently seen a reluctance from plan sponsors to adopt drug formularies out of concern for disrupting their employee group. There was a time when technology did not support a smooth transition to a managed formulary, but that time has passed.

Multi-tier drug plans use formularies with coverage percentages that differ based on the medications and the availability of therapeutically equivalent alternatives. Multi-tier plans create an incentive for patients to use specific drugs by using different co-payment terms for each tier (i.e. 80%, 50% and 20%).

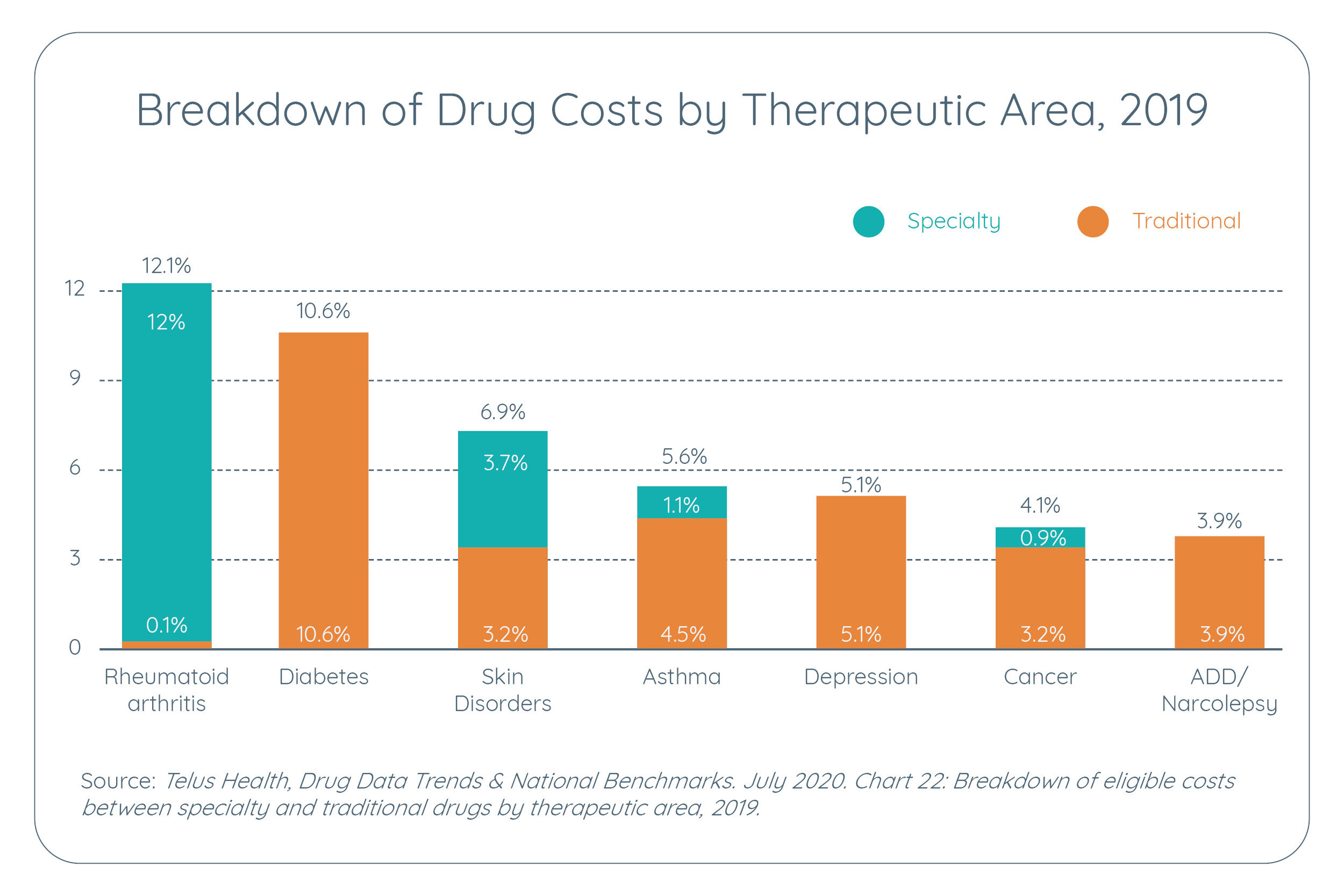

As pharmaceutical costs continue to rise, especially in the specialty drugs realm, it may be time for your company to address this issue through measures that can continue providing members with access to medications while reducing plan liability. The added benefit of reducing plan members’ out-of-pocket payments for premiums and drug co-pays is an alternative that deserves exploration. There is no doubt that costs are continuing their upward trajectory; the 2020 TELUS Health Drug Data Trends report outlines the eligible drug cost increase for 2019 at 5.1% (after removing the effect of the OHIP + impact), which is the highest increase in the last 5 years. This trend was driven by specialty drugs, which have more than doubled in the decade.

While high-cost drug treatments continue to add upward pressure, it is interesting to note that the number of plans with strategies – plan maximums and managed formularies - to mitigate these risks remains virtually unchanged for the period of 2015 to 2019. Plans featuring cost-containment strategies showed only a slight increase; plans with maximums increased from 16% to 21% and plans with managed formularies increased from 21% to 22%, according to TELUS Health, 2020. This represents a significant level of exposure and emphasizes the need to act now to mitigate this risk of dramatically increased costs to the plan.

I recently had the opportunity to speak with Helen Stevenson about her concerns within the pharmaceutical landscape. Helen is the founder and CEO of Reformulary Group, a healthcare technology company helping employers and their employees make smart medication choices. As the former Executive Officer of the Ontario Public Drug Program and Assistant Deputy Minister of Health, Helen has keen insight to the future pressures on the horizon. When I asked Helen, what keeps her up at night, she told me IV cancer medications once supported through provincial hospitals moving to private plans, as an acute pressure that will soon be prevalent.

The cost of doing nothing can jeopardize your ability as a plan sponsor to continue to support the same level of drug plan coverage. While potentially uncomfortable in the short-term, taking proactive measures may ensure your plan members continue to have access to the medications they need.

At Oak House Benefits, we’re here to help. Let us assess your drug risk profile, and help you optimize your drug plan for the years ahead. Please reach out and say hello – we can’t wait to hear from you.

Sandra Scott

Principal Consultant

Oak House Benefits

Source

Why Financial Literacy is Important to Me

Editor Update

It is hard to believe a year has passed since writing this article. We are still facing the same pandemic we were a year ago, but on a more personal level, my life has considerably changed. I got married, purchased a new vehicle, welcomed my first child into the world (do not recommend having a child during a pandemic—that was rough), and purchased what we hope to be our forever home to raise our family in (also do not recommend selling/buying a home with a three-month-old during COVID—not as fun as you would expect).

Having experienced several significant life events within such a short period of time has reinforced the importance of financial management. The conversations between my wife and I were no longer about us. They were about our growing family and how our decisions would impact our child. Our conversation about monthly spending and saving now included the additional cost of having a baby as well as the monthly cost of saving towards his educational future within a Registered Education Saving Plan (RESP).

When we were looking for our new home, it had to be forward-thinking. Will this space be enough when we have multiple children? How big is the yard? Can the children play without hazards? What is the school zone like? What is the proximity to our family? The number of factors that went into this decision was overwhelming. Not to mention the current housing market. But after viewing the house twice, putting in an offer and winning—we had a new forever home all within 24 hours from our first visit.

Thankfully, both my wife and I are very structured with our finances. We were able to sit down within that 24-hour period and build a new budget. We based our budget on what our current home could sell for, what the new home would cost, and determined the annual insurance on the new home including rough figures for heating, water, electricity, and property taxes. Our financial management is what allowed us to buy our forever home.

Understanding this is not the norm for everyone, but please remember it is never too late to start building a budget and planning for the future. If you would like help with supporting your employees in financial literacy and savings for retirement, feel free to say hello at csantos@oakhouse.com.

It is hard to believe that it has been one year since the world’s first positive COVID-19 test. The pandemic has impacted everyone in some way, shape or form. For many, it highlighted the importance of understanding and managing personal finances, and why having an emergency fund is critical. As I look back on this year, it has provided me with the opportunity to reflect on why I got into this business in the first place.

I come from a family of six, including my parents and three older siblings. We did not grow up in what I would consider a poor household, but I would not have classified it as middle class either. My parents were always able to provide us with shelter, food, and clothing, but we could not afford certain luxuries like family vacations. When I turned 16 years old, I got my first job. I used my earnings to pay for my school fees, uniform, cell phone, and athletic needs. I paid for my driving school and driver’s test, car insurance, and gas for when I used the family car. Upon graduation, I went to a three-year college program, which I paid for out of pocket by working part-time, sticking to a budget, and living at home.

Growing up, I held a grudge against my parents for making me pay for all these items on my own when most of my friends had a lot of it handed to them. Looking back now, I appreciate learning the value of a dollar along with the skills of budgeting and saving at such an early age. I can confidently say that this was not a life lesson my parents were intentionally teaching me—it was circumstantial.

At the start of 2008, I began my career in the financial services industry. I quickly realized that many Canadians did not understand their finances or the benefits of budgeting. This was highlighted by the crash of 2008 and subsequent pullbacks in the market. Being able to see firsthand how many people struggled during this time really shifted my focus. I knew then that I never wanted to feel the pressure and desperation I saw in others who were facing the loss of their home.

I knew I wanted to help other Canadians manage their finances properly, so in 2016, I obtained my Certified Financial Planning designation. My focus is to consult on the implementation and management of Group Pension and Retirement programs. One of the most important things I can do is support active communication with employees and ensure that ongoing education remains available to them. My passion to help others begins with teaching youth the same lessons I had to learn myself – understanding financial literacy and building positive habits at a young age supports a healthy financial future. I volunteer with Junior Achievement Canada teaching foundational courses in elementary schools, personal finance in high school and mentor in an after-school ‘company program’ where students learn how to start up and run a successful business.

The importance of financial literacy, budgeting, and saving is more front and centre today compared to any time before. I look forward to the potential of our youth, knowing that financial literacy education is supported in school through not-for-profit organizations.

We all have a "financial lesson" story to tell. Let us know if this resonates with you or your employees. We would love to partner with you to help support your teams in financial literacy and savings for retirement. Feel free to contact me at csantos@oakhouse.com.

Chris Santos, CFP

Group Retirement Consultant

Why Educating Today’s Youth in Financial Literacy Makes for a Better Tomorrow

This November marks the 10th anniversary of Financial Literacy Month in Canada. The impact of COVID-19 on the Canadian economy is unprecedented. Canadians were already burdened by rising levels of debt and, because of the pandemic, some are facing even greater financial pressures. Now more than ever, it is critical to help Canadians, especially youth, learn how to manage their finances. To highlight this, we spoke with Karen Gallant, Vice President of Programs and Charter Services at Junior Achievement Canada, along with high school math teacher, Katy Howell Escobar, who supports this program in her classroom.

Pictured here on the left is Karen Gallant, Vice President of Programs and Charter Services at Junior Achievement Canada.

Beside Karen is Katy Howell Escobar, a grade 11 mathematics teacher, who supports Junior Achievement Canada in her classroom.

Inspiring Students to Succeed in School, Life and Business

Junior Achievement Canada (JA) is the largest youth business education organization in Canada, with a national office and a network of 15 locations serving students from coast to coast. They work in partnership with educators, volunteers, and businesses to teach students about financial literacy, work readiness, and entrepreneurship.

Turning Today’s Students into Tomorrow’s Leaders

Karen explains that JA programs teach students vital financial management skills – earning, budgeting, saving, investing, and the importance of using credit wisely – giving them the knowledge and confidence to align their financial choices with their goals. Repeated studies and reports show that Canadians have rising levels of debt and live with financial insecurity. Through JA programs, they help students develop the financial skills and knowledge to proactively address these issues.

Small businesses are the backbone of the Canadian economy. JA programs teach students the fundamentals of running a small business and inspire them to launch businesses post education. According to a 2011 Boston Consulting Group report, JA graduates are 50% more likely to open a business, resulting in job creation and economic prosperity.

Students participating in a JA program develop confidence, resilience and a variety of other skills that are so necessary in their lives – both personal and professional. Not only do these skills benefit them as individuals, businesses and the community benefit from them as well. These students are the leaders of tomorrow, and through JA, they become well-equipped to fulfil that mission.

Pivoting Programs for Pandemic Success

For 100 years, JA had used a tried-and-true delivery method – volunteers would go into classrooms and facilitate our programs for students. When the pandemic closed schools in March, JA quickly had to pivot to digital program deliveries. Luckily, Karen and the team had already begun to develop a new learning management system (LMS) and were able to accelerate its launch by three months to meet this new need. Karen and the national team also worked with local JA teams to develop digital versions of the programs that both teachers and students could access remotely. As part of the digital transformation, JA had planned to develop digital programs, but COVID-19 accelerated that plan by two to three years.

Fortunately, JA continues to see strong interest from teachers, even though it may be more challenging for them this school year. Many teachers are now facilitating the programs themselves, including volunteers in a virtual way, or “assigning” the self-directed version of the program as homework to their students.

The Impact of the JA Program in Katy’s Classroom

Katy teaches grade 11 math every day, and explains that although it is very important, she is realistic in understanding that much of what she teaches may not be necessary in day-to-day life. By contrast, financial literacy is a topic her students can begin using in their daily decision making immediately. These students are off to post-secondary next year and, in many cases, will be living on their own for the first time. They will need to make many of the day-to-day decisions with their money that their parents have been making up until now. Having an expert in financial literacy teach them smart money management will set them on the path to financial success.

When Katy first introduces the JA program to her students, it is often not met with much enthusiasm. However, throughout the program, students become interested and involved in the learning. Her classroom JA volunteer is Chris Santos, Retirement Consultant at Oak House Benefits. Katy explains that Chris does a really good job of explaining the content but also brings in life experience and personal stories to add context to the information. Students always leave the program engaged and ready to tackle more financial topics. When she run into students after graduation, this is the one topic they always bring up as memorable and meaningful.

A Message for Parents

It may be tough to have discussions with your child about household finances, especially in these uncertain times. That also means it is more important now than ever to support children in financial learning and smart decision-making. Karen and Katy have shared the following messages to help foster conversations regarding a child’s long-term success in school, life, and business.

Talk to your kids about your own financial learnings, especially when you were their age. Help them develop those important budgeting and saving skills.

Recognize that your child’s career journey is unlikely to be linear, and that is acceptable. They need to learn what they dislike as much as what they like.

Entrepreneurship is an immensely viable career option!

Read on to Learn More!

If you would like to learn more about Junior Achievement Canada and ways to get involved in your local JA chapter, visit JACanada.org.

During Financial Literacy Month and throughout the year, you can find credible resources and tools on managing your financial health at Canada.ca/financial-tools.

Sources

www.canada.ca/en/articles-financial-literacy-month

www.canada.ca/en/financial-literacy-month/social-media-guide

Living with Diabetes: From One HR Professional to Another

November is National Diabetes Awareness Month in Canada, with World Diabetes Day falling on November 14. Diabetes is recognized as a global epidemic; in 2019, diabetes represented 10% of the global total health expenditure. As the number of people living with diabetes continues to rise worldwide, it is crucial not only to understand the facts and figures of the disease but to also understand its impact on the human experience. To highlight this, we have asked a mom (and HR professional) whose son was diagnosed at age 6 with Type 1 Diabetes (T1D), to share some personal insights and experiences.

November is National Diabetes Awareness Month in Canada, with World Diabetes Day falling on November 14.

Diabetes is recognized as a global epidemic; in 2019, diabetes represented 10% of the global total health expenditure. As the number of people living with diabetes continues to rise worldwide, it is crucial not only to understand the facts and figures of the disease but to also understand its impact on the human experience. To highlight this, we have asked a mom (and HR professional) whose son was diagnosed at age 6 with Type 1 Diabetes (T1D), to share some personal insights and experiences.

Advice to the Newly Diagnosed (or to the Parent of the Newly Diagnosed)

Be patient. Be diligent. You are not alone!

With a new diagnosis of diabetes, especially in the early days, you may feel helpless and not in control. Trust in the experience of your diabetes professionals – even if things feel foreign - because there is a lot to learn. There is a period of adjustment and lots of trial and error, but with good monitoring practices, you will soon find yourself in the swing of things. Don’t be afraid to use new practices or technology to help support your success. For example, using a food scale in combination with a food tracking app, can give you great insights into how to manage your dietary restrictions and requirements.

Lastly, and most importantly, remember that this diagnosis is not your fault; guilt or blame is not productive or helpful to the situation. Although you are focused on your or your child’s A1C (glycated hemoglobin measurement), carbohydrates to insulin ratio, and healthy eating, along with many other factors, do not overlook the effects of this diagnosis on your or your child’s overall emotional and social wellbeing.

From One HR Professional to Another

I know first-hand how challenging it can be for diabetics to wake up and function properly after a night of an unexplained sugar high/low. The challenge is not just the sleep deprivation – that effected is compounded by how one night of blood sugar instabilities can throw off the entire system and completely deplete a person’s energy and stamina. As (HR) professionals, we need to continue to drive and support preventative medicine. Ensuring that your plan has sufficient coverage for life sustaining medications, supplies, and even paramedical practitioners is the most effective way to support employees living with and managing diabetes.

Diabetics, and others living with life altering medical conditions, work hard to ensure that their medical condition does not define them, control them, or impact their lives (physically or mentally) in such a way that their quality of life is impaired. In recent years, HR professionals have come to realize, more than ever, the importance of mental health awareness and support in the workplace and that the spectrum of good mental health varies for every individual, and is impacted by so many things – chronic health concerns, included. We need continue to find ways to balance the needs of our organizations with the needs of these dedicated, caring people.

The Impact of the Benefit Plan

Coverage for diabetic pumps and testing supplies (i.e. needles, insulin, lancets, etc.) have, thankfully, been a component of most benefit plans for some time. That said, given how rapidly these items are used up, the frequency of the permissible replacements for diabetic supplies has left something to be desired. Nobody should have to use an insulin pump to the point of failure to be considered for replacement eligibility – these are life-saving devices, and the risk associated with their failure is catastrophic, which is a frightening consideration. To help stave off gaps in replacement coverage, having a small, “just in case” supply of your key testing supplies is good planning for the diabetic, or the parent of a diabetic.

The Last Word – Diagnosed with Type 1 Diabetes at the age of 6, now 22

I never wanted to be treated differently. Especially when I was younger, I did not want people to know or ask me about diabetes or pump. After recognizing the prominence of this disease and understanding how my personal situation has impacted my mental health, I now welcome questions and take the opportunity to help others with their journey. There are so many more people with T1D than I ever imagined.

Sources

Remembrance Day

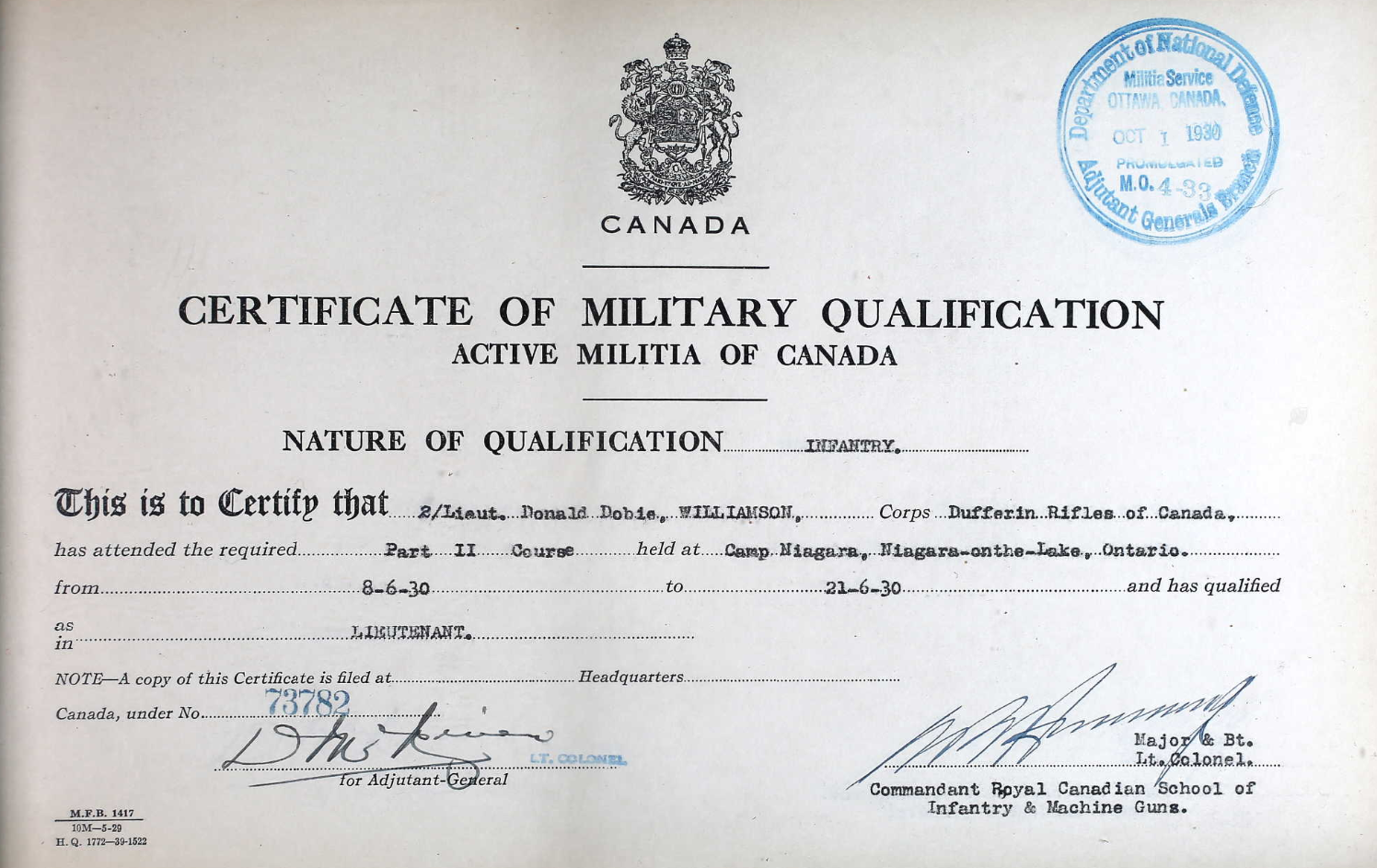

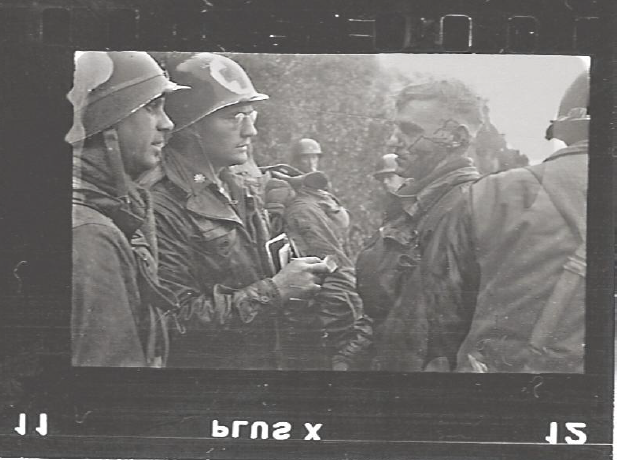

This Remembrance Day, we recognize 3 generations of the Williamson family. Today, and always, we thank you for your service.

This Remembrance Day, I want to recognize 3 generations of the Williamson family. My dad, Paul Williamson, serves as the Honorary Colonel of the 56th Field Artillery Regiment. When he retired from The Williamson Group, he remained committed to giving back to the community. He chose the 56th to not only support the community but to honour his father, Colonel Donald D. Williamson, the top-ranking Canadian in the First Special Service Force (FSSF) formed during WWII as the first multinational (Canada/US) elite commando force. During his service, he fought for equality in compensation and recognition for his Canadian men who were fighting alongside their American counterparts. This fight persists today; equal work deserves equal pay and our work to make this a reality is not yet done. Continuing to honour these values is my niece, Emma Williamson, who is the author of "Lessons From Soldiers and Veterans For the Youth of Today", a collection of stories and memories shared through her conversations with Canadian Veterans. We are proud to have a limited supply of Emma's books for sale in our office, with 100% of the proceeds being donated back to the brave soldiers of the 56th Field Artillery Regiment.

Today, and always, we thank you for your service.

Getting Ready for Holiday Shopping

If you are thinking – How can I limit my spending over the holiday season? Here are a few tips to ensure that you spend within your means.

In just 60 days, Canadians will be celebrating the holidays with family and friends, but this year will be very different compared to years of past. The COVID-19 virus has impacted every one of us, and as we face a second wave many of us can expect to forego the in-person parties and instead have virtual gatherings with loved ones. The 2020 Deloitte Holiday Retail Outlook survey shows that 51% of Canadians will avoid entertaining altogether and only 26% are planning to have in-home entertaining over the holidays.

Canadians love to spend on one another, especially during the holidays. However, with some of us experiencing a reduction in income or relying on CERB (transitioning to EI), we should be looking for cost savings opportunities and financially responsible habits with uncertainty ahead.

A survey completed by Canada Post shows that 32% are planning on spending less compared to last year, while 61% are planning on spending the same and 7% reported on planning to spend more this holiday season. According to the 2020 Holiday Retail Outlook report from Deloitte, Canadians will be cutting back on spending with respect to gifts/gift cards and alcohol for entertainment, along with a significant decrease in travel costs $104 in 2020 compared to $348 in 2019). While there are saving plans described in this outlook, it is nice to note that giving to charities has an increased estimated spending from $87 in 2019 to $158 in 2020.

If you are thinking – How can I limit my spending over the holiday season? Here are a few tips to ensure that you spend within your means.

1) Create a list and detail how much you plan on spending per person.

Feel free to adjust the list and cost per person to accommodate your budget.

2) Reduce, Reuse, Recycle: decrease cost and waste by using alternative wrapping materials.

Read the article, Eco-Friendly Gift Wrapping Ideas, for great ways to save!

Keep track of additional expenses like wrapping paper, cards, etc. and ensure to subtract this cost from what you had expected to spend over the holiday season to ensure you stay within budget.

3) Start shopping early and look for sales.

Black Friday, Cyber Monday and other sales leading up to the holiday season can help you save.

4) Look for alternative ways of gift gifting for those on your list.

Use points from your credit card or loyalty programs.

Hand made gifts have a personal touch that can mean a lot more than a store-bought item.

5) Lower overall costs by limiting who you spend for.

If you have a large list of loved ones you need to buy for, opt-in for a Secret Santa and limit the overall cost by buying for just one person

If you plan to shift to online shopping this holiday season, which 48% of Canadians are, keep a look out for sales starting earlier than prior years as retailers are trying to get ahead of the potential supply-chain demands. Shopping online might be new for some, so here are a few items to keep an eye out for if you are shopping online.

Cost of shipping (which should factor into your overall budget)

Delivery date of the gift

Research the return policy – Is it easy to return or exchange the gift? How many days do they have to return?

As the weather continues to change and cold and flu season is amongst us, we ask all those who are venturing to malls for their holiday shopping to practice appropriate physical distancing, wear face masks and stay safe. We hope everyone takes care of one another during this holiday season!

Chris Santos, CFP

Group Retirement Consultant

The Impact of Rheumatoid Arthritis to Your Plan and Plan Members

Today, October 12, is World Arthritis Day. On this day, patient advocates and other organizations around the world promote awareness of arthritis symptoms and champion the importance of early diagnosis and intervention. In honour of this initiative, we thought we’d highlight rheumatoid arthritis (RA) as it may affect you, your people, and your benefit plan.

Today, October 12, is World Arthritis Day. On this day, patient advocates and other organizations around the world promote awareness of arthritis symptoms and champion the importance of early diagnosis and intervention. In honour of this initiative, we thought we’d highlight rheumatoid arthritis (RA) as it may affect you, your people, and your benefit plan.

RA is an autoimmune disease; this means that it is a disease in which the immune system misinterprets healthy human cells or organs as disease-causing and launches a defensive attack against the healthy body. In patients with RA, the immune system attacks the musculoskeletal system, joints and connective tissues causing debilitating pain and inflammation. RA should not be confused with the aches and pains associated with aging – those are generally due to osteoarthritis, which is more mechanical in nature and caused by a progressive breakdown in the protective tissue cushioning our joints. RA is more prominent in women, with symptoms typically appearing around age 40. Rheumatoid arthritis is a bit of an enigma; we’re not entirely sure what causes it or why it manifests in one person over another. What we do know, is that having a family member with RA can increase your likelihood of developing this disease. Its unpredictability – along with the unpredictability of many other autoimmune disorders – is the most persuasive argument for why we need to learn more about this diagnosis and its treatment plans.

The Sanofi Canada Healthcare Survey 2020 reports that two-thirds of plan members live with a chronic condition and/or chronic pain. More than half of these plan members report that their condition has a negative impact on their job performance. The negative impact translates to diminished job performance, missed work hours, and increased use of sick days. Ultimately, unmanaged impairments lead to full work absences and increased Short-Term Disability utilization; this doesn’t have to be the case. Proactivity and an understanding of how to make treatments accessible and affordable for your employees is key.

Rheumatoid Arthritis is treated with a varying regiment of drugs focused on reducing localized and systemic inflammation. These drugs range from over the counter, nonsteroidal anti-inflammatory drugs (NSAIDS) to disease-modifying antirheumatic drugs (DMARDs), depending on severity of the patient’s condition.

The Telus Health Drug Data Trend & National Benchmarks Report 2020 indicates a doubling of the specialty drugs share of eligible drug plan costs - from 14% to 30% - over the last ten years. The number of claimants remains steady at around 1% - when a small population of your employee base is driving cost, that’s a statistic worth noting. Specialty drugs are forecasted to represent 46% of the average month certificate cost by 2025. What can we take away from this? Chronic pain is costly – to your employees, and to you.

Many RA drugs are classified as biological drugs – drugs that support and encourage the body to perform its natural function and tame the immune response which attacks healthy cells. Historically, these medications have brought with them tremendous results, but at a significant cost. Times are changing and several of these revolutionary medications now have the availability of a biosimilar replacement. Biosimilar drugs are approved according to the same standards of pharmaceutical quality, safety, and efficacy that apply to all biological medicines. What you need to know is that a biosimilar has “no meaningful differences” between it and its brand-name biologic medication. As an example, Remicade is the originator drug to Inflectra, a biosimilar medication, which brings a price tag of approximately half the cost of Remicade.

Protect your plan and plan members through a balance between reasonable patient access and sustainable financial responsibility. If you haven’t already taken the steps to do a full review of your drug plan formulary, including your insurance providers plan to take full advantage of the cost saving from biosimilar drugs – do so now. While we can’t eliminate the costs of chronic pain, we can help mitigate and manage those, together.

TAKEAWAY: Manage costs while supporting healthy outcomes for your people and your business. Working together with OHB, we can bend and influence this curve, too!

Happy Thanksgiving!

We are so thankful for all the support we have received – from our clients to our carrier relationships and for every ounce of community support in between!

We hope your long weekend is filled with joy, love, laughter, and gratitude. Happy Thanksgiving!

It’s amazing how far we’ve come in only a few short months. We’ve taken a dream to a concept, a concept to a plan, and a plan to a reality…all while dealing with one heck of a wildcard year. Above all, for us, is an overwhelming feeling of gratitude; that we’ve been able to grow, to strengthen the work we do with team we have built. Nothing feels better than knowing we’re working to establish deep-rooted longevity. And nothing feels better than acknowledging our supporters in our deepest spirit of gratitude. We were not able to do this alone – because of you, we are.

We are so thankful for all the support we have received – from our clients to our carrier relationships and for every ounce of community support in between! Thank you for being a part of our journey this year and for your excitement in joining us on the most amazing adventure ahead.

We hope your long weekend is filled with joy, love, laughter, and gratitude. Happy Thanksgiving!

Remembering Terry Fox on the 40th Anniversary of his Marathon of Hope

This Sunday, September 20th marks the 40th anniversary of Terry Fox’s Marathon of Hope. We are proud to honour the life and legacy of this Canadian hero who has been a source of inspiration and hope to millions around the world.

“…I want to set an example that will never be forgotten.”

- Terry Fox, April 26, 1980

This Sunday, September 20th marks the 40th anniversary of Terry Fox’s Marathon of Hope.

At only 18 years old, Terry Fox was diagnosed with bone cancer and had to have his right leg amputated several centimeters above his knee. But he didn’t let this struggle stop him. The night before his surgery, Terry set out a goal to run across Canada in hopes of raising awareness and donations for cancer research. He called this journey the Marathon of Hope.

After dipping his artificial leg in the Atlantic Ocean, Terry began his run in St. John’s, Newfoundland on April 12, 1980 inspiring Canadians to donate with his passion and perseverance. Unfortunately, after a 5,373 km journey, Terry ended his run near Thunder Bay, Ontario as the cancer spread to his lungs. Terry Fox passed on June 28, 1981, but his legacy lives on.

We are proud to honour this Canadian hero as he is a powerful source of inspiration to Canadians and millions of others around the world. Terry has taught us that, no matter how difficult the circumstances, we can make a difference in the lives of others when we stand together.

We have gathered some of our favourite stories of those inspired by Terry and are continuing his work.

Luca, local Brantford resident and deafblind, raises double his fundraising goal while participating in the 2019 Brantford Terry Fox Run

Will Dwyer, 95-year-old prostate cancer survivor, raises over $1,000,000 for The Terry Fox Foundation

CTV News, Canada: 94-Year-Old WWII Veteran Hits 1M Fundraising Goal for the Terry Fox Run

CTV News, Barrie: Will Dwyer Returns to the Barrie Farmers Market

Ethan Smallwood, 7-year-old superfan of Terry, raises over $25,000 in cancer donations at Halloween

Helping Your Child Grow

Parents play a major role in guiding healthy habits for their child’s development while providing opportunities for learning and growth. This guide provides you with easy to follow checklists, tips, and resources to help with your child’s overall long-term health.

Parents play a major role in guiding healthy habits for their child’s development while providing opportunities for learning and growth. This guide provides you with easy to follow checklists, tips, and resources to help with your child’s overall long-term health.

Helping your Child Grow: Parental Support Guide for Child Health

Benefits Canada - Annual Consultants Directory

There is something exciting about seeing your company listed in Benefits Canada Annual Consultants Directory amongst your peers in the industry; it feels great to get the word out about Oak House Benefits!

There is something exciting about seeing your company listed in Benefits Canada Annual Consultants Directory amongst your peers in the industry; it feels great to get the word out about Oak House Benefits. You can check out the latest issue from Benefits Canada to review the Annual Consultant’s Directory and for insights on how the coronavirus pandemic is changing the future of workplace benefits and pension plans.

Change is everywhere these days. There is so much fun in being a young, dynamic company, evolving and adapting alongside our client partners, in sync with their needs. Since making our submission to Benefits Canada some months ago, Oak House Benefits has changed, too - we’ve added Group Retirement Consulting to our suite of services and are happily brainstorming on more growth. I can't wait to see the updates we will have to share with you for the 2021 edition

Branching Out into New Services

Since launching Oak House Benefits at the beginning of the year, we have worked hard to grow and strengthen the roots of the work we do. Today, we are thrilled to announce more growth; a new branch of service - Group Retirement – and the newest member of the Oak House Benefits team, Chris Santos, in the role of Group Retirement Consultant.

Since launching Oak House Benefits at the beginning of the year, we have worked hard to grow and strengthen the roots of the work we do. Today, we are thrilled to announce more growth; a new branch of service - Group Retirement – and the newest member of the Oak House Benefits team, Chris Santos, in the role of Group Retirement Consultant.

Chris has over a decade of experience in the group pension and retirement industry, honed through years of service with one of the major life insurance companies and through his work within the consulting and banking industries. Chris has a passion for client service, supporting group retirement solutions through plan design and technical expertise, administration, employee communication, investment support and individual financial guidance.

Chris’ accreditations are a testament to both his passion for our industry and his commitment to service excellence. He has completed the Mutual Funds Course, Canadian Securities Course, Ontario Life License program, and received his Certified Financial Planner (CFP) designation. Currently, he is working on the last course required to obtain his Retirement Plan Associate (RPA) designation.

Outside of work, Chris actively volunteers with Junior Achievement as a mentor for their after-school Company Program. You can occasionally find him teaching their high-school Personal Finance program, Dollars for Sense, and teaching Economics for Success at local elementary schools.

Chris truly shares our commitment to making a difference in the lives of our clients, colleagues, and the communities we live, work, and play in. Please join us in welcoming Chris to our Oak House family!

If you are looking for group retirement solutions, don’t hesitate to reach out at anytime - we are here to help.

A Beginner’s Guide to Self Care

The benefits of self-care are crucial. If we don’t take care of ourselves we leave very little to give back to those that we love and value the most: friends and family; clients and colleagues. Click through to view our self-care guide for easy ways to find joy in your every day.

The benefits of self-care are crucial. If we don’t take care of ourselves we leave very little to give back to those that we love and value the most: friends and family; clients and colleagues. We pledge to do better, so we can be better for our family, team, and community. Join us in committing to do your part, to invest in a healthier, more peaceful, more resilient you. Follow our self-care guide for easy ways to find joy in your every day.

Self-Care: Treat Yourself to Better Health

International Self-Care Day takes place every year on July 24th signifying that the benefits of self-care are felt 24 hours a day, 7 days a week. Self-care goes a long way in preventing disease, enhancing mental health, and allowing you to live your best life. Follow along to learn more about self-care, including why it is essential and the 7 elements that encompass it, as well as tips and resources to help you get started.

International Self-Care Day takes place every year on July 24th signifying that the benefits of self-care are felt 24 hours a day, 7 days a week. Self-care goes a long way in preventing disease, enhancing mental health, and allowing you to live your best life. Follow along to learn more about self-care, including why it is essential and the 7 elements that encompass it, as well as tips and resources to help you get started.

What is Self-Care?

The World Health Organization describes self-care as,

“the ability of individuals, families and communities to promote health, prevent disease, maintain health, and to cope with illness and disability with or without the support of a healthcare provider.”

Simply put, self-care comprises of anything involved with managing our psychological and physical wellbeing, ultimately supporting better health outcomes.

Why is Self-Care Essential?

Prevention of Disease

Lifestyle diseases, including heart disease, stroke, cancer, diabetes, and chronic lung disease, are estimated to account for 88% of all deaths in Canada (WHO, 2018). The rise of these diseases has been primarily driven by four main risk factors: tobacco use, physical inactivity, substance abuse, and unhealthy diets. By modifying our habits, maintaining an active lifestyle, and consuming a healthy diet, we can reduce our risk of disease.

Improved Mental Health

It is easy for us to feel overwhelmed when faced with unprecedented or stressful situations, which can lead to interference with our regular cognitive functioning and cause feelings of uncertainty, anxiety, and stress. When we take initiative to feel mentally, emotionally, and physically healthy, we have a propensity to be more resilient when encountering stress or adversity.

Increased Efficiency and Innovation within the Healthcare System

Through effective self-care, we become active decision-makers in our healthcare enabling us to prevent, test, and treat some of our health conditions on our own. This can be accomplished with self-care health interventions, which include drugs, devices, diagnostics, and digital products that are provided partially or entirely outside of formal health services. Implementing self-care health interventions and other self-care initiatives can help our healthcare system stay sustainable in the long-term.

Seven Pillars of Self-Care

The International Self-Care Foundation (ISF) has developed a framework for self-care to help individuals understand all the elements that encompass self-care for practical and successful implementation.

1. Health Literacy

Health literacy is the motivation and ability to access, understand, and use health information and services to make informed and appropriate health decisions.

2. Mental Wellbeing

Mental wellbeing is a state in which an individual realizes their potential, can cope with the normal stresses of life, can work productively and effectively, and is able to contribute to society. Mental wellbeing is comprised of self-awareness and agency. Self-awareness allows for practical application of our health knowledge to our own health situation. Agency then allows us to act on our knowledge and awareness to produce a better outcome. Examples of self-care practices within this pillar include blood pressure and cholesterol level checks and regularly participating in health screenings.

3. Physical Activity

Regular moderate intensity physical activity is essential to good long-term health as it can improve mood, control weight, and reduce the risk of lifestyle diseases. Physical activity can include walking, playing sports, cycling and yoga.

4. Healthy Eating

Consuming a nutritious and balanced diet has continuously shown evidence of preventative benefits, reducing risk of lifestyle diseases.

5. Risk Avoidance/Mitigation

Reducing or avoiding behaviours that directly increase the risk of disease reduced the risk of premature death. Self-care behaviors can include quitting tobacco, limiting alcohol use, using sunscreen, getting vaccinated, and wearing a seat belt while in a vehicle.

6. Good Hygiene

Good hygiene practices prevent the spread of disease and help maintain good health. These practices include washing hands regularly, brushing teeth and food safety practices.

7. Rational and Responsible Use of Self-Care Products and Services

The rational and responsible use of health products and services can help in safely managing health, including the treatment of minor ailments. These health products and services also support health awareness and healthy practices. Examples of self-care tools within this pillar include routine use of medications prescribed by a doctor, home blood pressure monitors, smoking cessation programs, gym memberships, and acupuncture.

Self-Care Strategies

Make use of your group benefit plan.

Get use out of your group benefit plan through dental care, drug plan, and paramedical services. Your plan can help prevent long-term health issues, effectively treat current health conditions, and achieve overall physical and mental restoration.

Keep your body active.

Daily physical activity is one of the most valuable ways to achieve both mental and physical wellbeing as it reduces stress, enhances mood, and keeps your body healthy and strong.

Form healthy eating habits.

Consuming a nutritious and well-balanced diet supports our immune system, increases energy levels, and enhances our overall mood.

Prioritize a good night’s sleep.

Allowing your body to revitalize itself each day helps with balancing our mood and increases cognitive functioning as well as mental clarity.

Check in with yourself through journaling.

Jotting down important to-do items, scheduling in time to take care of yourself, like exercising or eating, and reflecting at the end of the day can help us feel better throughout the day.

Practice mindfulness and meditation.

Exercising mindfulness through meditation and controlled breathing helps us tackle stress and anxiety leading to better mental health. There are popular free and low-cost mindfulness apps, like CALM and Headspace, that can help provide guided meditations and additional resources.

Practice gratitude and give back to the community.

Practicing gratitude in tough times can help inspire a positive mindset. Alternatively, volunteering can provoke feelings of gratitude and create meaningful connections within the community.

Set healthy boundaries.

Setting boundaries helps us look at our needs and prioritize activities that will help us reach our goals.

Stay social.

Whether it’s a phone call with a family member or dinner with friends, having a support system enhances our positive mental health.

Treat yourself.

Taking part in our favourite hobbies or treating ourselves to a healthy indulgence is a great way to de-stress as well as re-establish a positive and creative mindset.

Finding Help and Additional Information

Below are some resources for anyone facing health challenges in Canada. Please note that if you are in crisis, please go to your local hospital or call 911 immediately.

Crisis Hotlines

1-800-668-6868

1-833-456-4566; residents of Quebec: 1-866-277-3553; text #45645 (English only) from 4:00 p.m. to 12:00 a.m.

1-866-996-0991 (available 24/7)

First Nationals and Inuit Hope for Wellness Help Line

1-855-242-3310 (available 24/7 and live chat available online)

Talk4Healing For Indigenous Women

Call or text 1-855-554-HEAL (live chat available)

Canada Drug Rehab Addiction Services Directory

1-877-746-1963

National Eating Disorder Information Centre

1-866-633-4220

Resources for Information about Mental Health

Canadian Association for Suicide Prevention (not a crisis line)

613-702-4446

Canadian Mental Health Association

416-646-5557

Canadian Psychological Association

1-888-472-0657

613-683-3755

Resources for Information about Self-Care during COVID-19

Ontario Mental Health, Wellness and Addictions Support

Self-care tips for managers and their teams during COVID-19

Helping your team during COVID-19

Quick tips to support yourself during the COVID-19 pandemic

Managing Stress, Anxiety, and Substance Use during COVID-19

Sources

https://gesund.ca/international-self-care-day-2020/

https://isfglobal.org/international-self-care-day/

https://www.who.int/reproductivehealth/self-care-interventions/definitions/en/

https://www.who.int/nmh/countries/2018/can_en.pdf?ua=1

https://www.who.int/health-topics/noncommunicable-diseases#tab=tab_1

https://www.newswire.ca/news-releases/international-self-care-day-2019-884620932.html

https://isfglobal.org/what-is-self-care/

https://www.selfcarefederation.org/news-events/international-self-care-day

https://theworkingmind.ca/sites/default/files/twm_self-care-resilience-guide.pdf

Father's Day 2020

This past Father’s Day, I shared some special moments with my dad as we walked through the Oak House Benefits office together for the first time, growing excited for the future of my new company and reminiscing about the earliest days of The Williamson Group.

I was proud to show him our downstairs kitchen space and to share my vision of making it like many other kitchens; the heart of a home. I hope it will be a place where both the team and clients can unwind together. We strolled together while he took in all the spaces earmarked for future growth – from the training room where I will be holding education sessions for our team and clients, to the future homes of offices and collaborative workspaces eagerly awaiting more creative minds and spirits to fill them. Our new office space is not just for the here and now, it’s built on the dream of planting the seeds for the future. A lesson learned from my dad, and realized in Oak House Benefits.

Of the entire tour, I think my dad’s favourite part was listening to me crank the tunes in the office “just to check the acoustics.” Anyone who knows PW (as we affectionately referred to him at The Williamson Group) knows he would also “check the acoustics” whenever he had guests in his office. So in homage, I cranked Gnarls Barkley’s “Crazy” and AC/DC’s “Rock ‘n’ Roll Ain’t Noise Pollution”. It was a great father-son moment and my gratitude for my dad’s support and advocacy as a mentor has been at the forefront of my thoughts as I’ve embarked on this journey. So much of who I am as a father, a partner, a friend and a professional is because of my dad, and today I am so glad to celebrate him.

Happy Father’s Day, Dad. I love you.

Friendship

Our roots are getting stronger, both figuratively and literally. Here is a short article, featuring a dose of gratitude. It takes a village, even as an adult entrepreneur.

Yes, I am mixing my proverbs, but I find myself reflecting on how relevant both have been to Oak House Benefits (OHB) over the last several months. It is due entirely to the love and support of our village that we have transformed from an idea voiced uncertainly over dinner, to the proud reality being shared here, and beyond.

A couple weeks ago, I made an “impromptu” trip to the office (with tongue firmly in cheek, as these days, my impromptu visits tend to happen every weekend). As part of our plans to run errands, I had family in tow and had only a mild sense of fishiness when my partner suggested we park at the back of the building, instead of at the front as we usually do. As we rounded the corner, out came her telephone to record my reaction, and into view appeared a familiar car occupied by a familiar face. As I tried to process my disjointed thoughts, another familiar car with two more familiar faces pulled into the parking lot.

Imagine my surprise to realize that they had all come together to surprise and congratulate me on the opening of this new office, and to celebrate the progress made at OHB. They had taken the time to select, purchase, deliver and plant two young oak trees at the back of our property over the weekend. There were bows on the trees, watering cans in the car and the promise of stakes and burlap and care instructions to follow.

Thoughtful. Generous. Wonderful. These are just some of the amazing people in our Oak House Benefits village. Without their unwavering support and encouragement over the last several months, there may have not been a place to plant those trees. There may not have been an occasion to celebrate new growth, or an opportunity to learn and reflect that oak trees first channel their growth downward to form solid roots before they refocus energy to drive their growth upwards.

I am so grateful, and fortunate to have support like this as we grow OHB. Especially from friends like Margot Neill, John Hall, and Shannon McMannis, the familiar faces in the familiar cars.

Because of the many hands of our village, our journey here has been much lighter work, indeed. Thank you again, for helping us plant not only our figurative roots, but our literal roots as well.

The Challenging Journey of Returning to Work with an ABI

In late July of 2019, Ellie took a fall off her horse drastically changing her year to follow. After spending the night in hospital with what she thought was a hip injury, the CT scan came back showing Ellie had a brain bleed and resulting concussion. Ellie quickly realized her chance of returning to work in the coming weeks was slim.

“Brain injuries are difficult to understand and manage. If someone tells you they have a brain injury, they need time and support to recover.”

In late July of 2019, Ellie took a fall off her horse drastically changing her year to follow. After spending the night in hospital with what she thought was a hip injury, the CT scan came back showing Ellie had a brain bleed and resulting concussion. Ellie quickly realized her chance of returning to work in the coming weeks was slim.

Returning to work is a significant driver for individuals recovering from an acquired brain injury (ABI), helping them to regain independence and balance. Ellie’s immediate concern during her overnight hospital visit was how to deal with the workday she had missed. However, for Ellie and many others, the road to recovery and returning to work is a challenging and unique journey for each ABI patient.

A Hasty Return to Work

Four weeks following the injury, Ellie made the decision to return to work. Starting with two hours daily, Ellie struggled with her ability to concentrate, leading to severe and persistent headaches and fatigue. After one week of her return to work, she quickly realized that her recovery required more time. Ellie and her employer set her return to work on pause so she could get the rest and medical treatment necessary to progress.

“Even if I had a good night’s rest, I only had enough concentration and brain power to perform one or two tasks a day. That would be the most I could handle.”

She had attempted several treatments, including medication, physiotherapy, massage therapy, and chiropractic work, but the headaches continued to persist. It was not until eight months from the date of her injury that she went to a pain management clinic to receive nerve blocking treatments. Since March, Ellie’s headaches have been subsiding, which has been a huge step forward in her recovery.

Small Wins Spark Great Triumphs

As Ellie progressed through her recovery, she received a great deal of support from visiting the farm to see her horses. Although it took a long time to get back on the saddle, Ellie began performing simple tasks around the farm to feel a sense of routine, belonging, and independence. During recovery, it is crucial for ABI patients to take part in former, routine activities to stimulate brain function and encourage motivation and positivity with their progress. Eventually, she started riding again, increasing her ability to concentrate with a familiar activity.

“If you are able to keep a positive outlook and grasp small victories, it makes a huge difference for your progress.”

Strides in Progress

Ellie’s progress has now advanced to where she feels confident enough to restart a return to work plan with her employer. For many, work is a significant facet of life where one gains a sense of achievement, growth, and independence. As an employer, building a proactive and thoughtful return to work program can assist individuals with ABI progress through their recovery and re-establish themselves. Your efforts to understand, accommodate and support employees impacted by acquired brain injuries creates a meaningful difference.

“Brain injuries are difficult to understand and manage. If someone tells you they have a brain injury, they need time and support to recover.”

To learn more about acquired brain injuries and how to facilitate a return to work program for those impact by ABI, visit our article, Building a Successful Return to Work Plan for ABI Patients, or email us at hello@oakhouse.com for more information.